The cost of home remodeling projects in Seattle can be a bit shocking, but will your investment pay off?

Although there is no financial crystal ball (...don't we all wish there was?!...), here are some tips for making an informed decision:

- Find out the typical annual appreciation for homes in your neighborhood. You can research data on neighborhoodscout.com, or ask a local real estate agent to provide you with data even more specific to homes like yours. Using neighborhoodscout.com's 7% average over the last 5 years is a conservative approach, given that the past 5 years includes some of the recession recovery period and factors in both the most and least desirable neighborhoods.

- Research the immediate return on investment percentages for project types like yours. The annual Cost vs. Value report published by remodeling.hw.net is a great resource.

- Answer honestly: What is the least amount of time you will live here?

- Include both "hard costs" and "soft costs" when estimating Total Cost of Your Remodel Project. (And don't forget to add things that might not be included in the contractor's estimate, such as appliances, cabinet knobs, decorative light fixtures, and accessories.)

Sample data:

Current Home Value = $800,000

Total Cost of Your Remodel Project = $600,000

Total Investment = $1,400,000 (assuming that you don't have any equity)

Minimum Number of Years (that you will live in the house) = 10

Immediate Return on Investment (ROI) Factor for project type = 70% (conservative, based on lowest end of the ROI range for upscale Seattle projects)

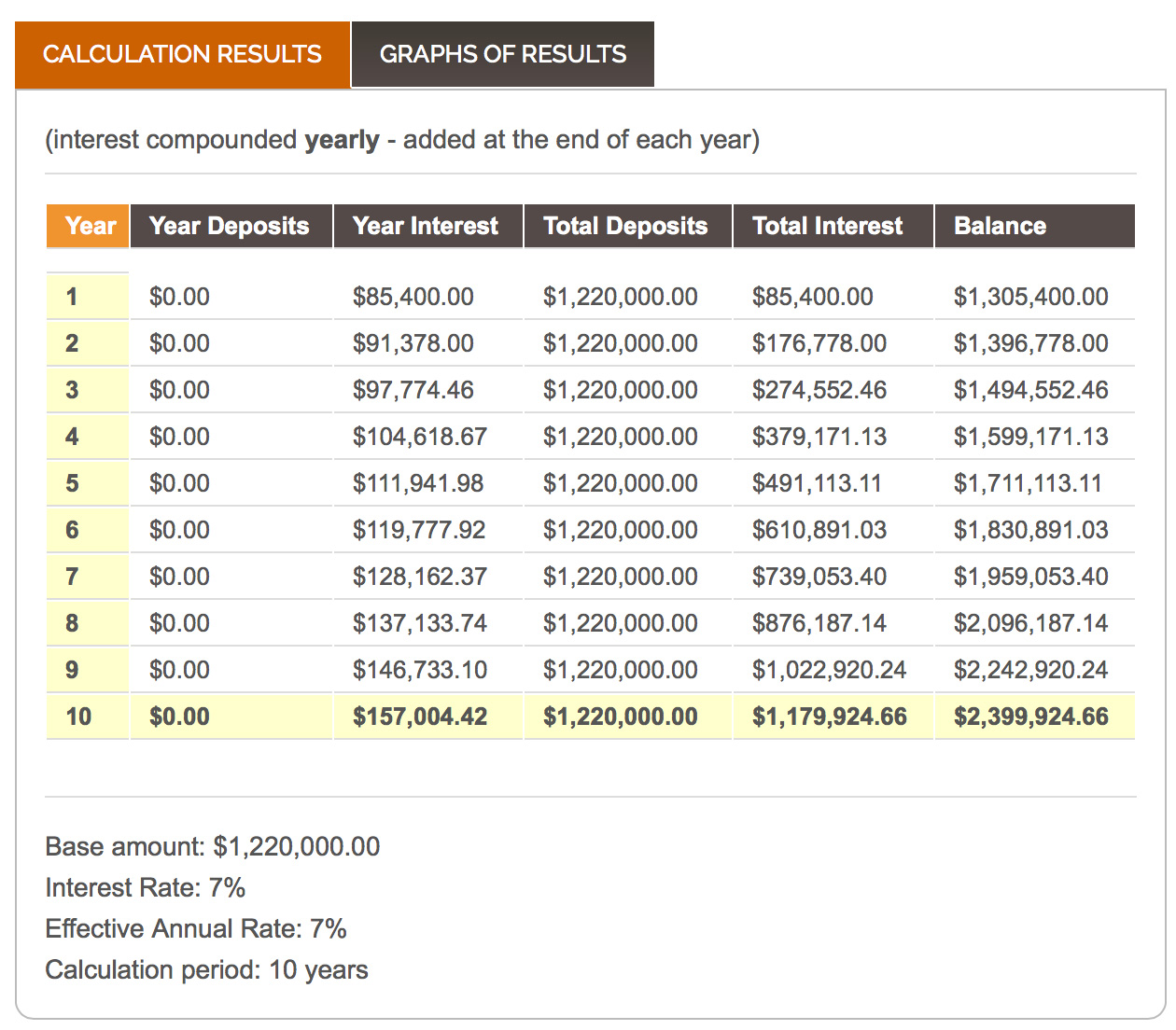

Average Annual Real Estate Appreciation (conservative) = 7%

Sample calculation:

First, calculate your immediate ROI Value.

Current Home Value + (Immediate ROI Factor x Total Cost of Your Remodel Project) = Immediate ROI Value

$800,000 + (0.70 x $600,000) = $1,220,000

Then use an online compound interest calculator to calculate your home's Projected Value at the end of the Minimum Number of Years.

Then, calculate your Projected Profit.

Projected Value - Total Investment = Projected Profit

$2,399,924.66 - $1,400,000 = $999,924.66

So, although you would have started out with more money invested than you could immediately recoup, in ten years time, you will have more than made up for it. And, consider the intangible. You need to live somewhere. Why not live in a home that is designed to work well for you and will bring you joy for years to come? I can help you with that.